XM is one of the most popular exchanges among traders and many people know about it not only in the Vietnamese market but also in the international market. So why is XM floor so trusted by investors? What are its outstanding advantages and disadvantages? Let's learn about XM floor through the review process at Traderforex right below.

Operating license of XM Forex floor

Business license is one of the typical factors that help XM create prestige to help investors trust this market because having a business license proves that this exchange is managed by an organization. Certain organizations will have a higher level of safety than underground exchanges without a business license.

Information about business licenses

XM Forex is a reputable trading platform licensed by many financial organizations such as:

- License number 120/10 licensed in Cyprus comes from the Cyprus Securities and Exchange Commission

- License number 443670 licensed in Australia comes from the Australian Securities and Investments Commission

- License number IFSC/60/354/TS/18 issued by IFSC

- License F003484 comes from Dubai Financial Services Authority

XM is licensed by many financial institutions, so XM is under their supervision, so all information must be clear and accurate, ensuring customers' rights to avoid wrongdoing, especially money laundering. .

XM and the assurance of customer rights through licenses

Separate accounts and liquidity guarantees

Because XM received an operating license from a highly responsible business, ASIC from Australia, ASIC also has very high requirements for ensuring the safety of private accounts. So. When trading on XM, customers will have two types of accounts: one is responsible for holding deposits and the other is money from the exchange. These two accounts are completely independent of each other, which will help ensure capital safety and avoid cases where deposits are used for their own purposes in the Forex market. Through that, traders' investment money is always protected and guaranteed to be safe even if they go bankrupt. This is one of the leading factors that helps XM always receive favor from many investors.

Insurance in case of bankruptcy

CySEC has licensed the operation of XM exchange, so this exchange must comply with all of CySEC's directives and protect the interests of investors. The highest insurance mechanism for customers at 20,000 Euro comes from the compensation fund for investors.

There is capital safety with value with minimum CySEC and ASIC regulations

The safety of capital is guaranteed by XM Global Limited (this is also the unit that currently operates XM) according to specific current regulations. In addition, XM received a request from the securities service to ensure labor capital to ensure safety for traders and ensure costs when fluctuations occur. Every year XM will have auditing companies check their annual financial statements.

Ensuring and completing the requirements given by managers has created high reputation for XM and XM has also affirmed its financial position in the world market through this.

However, when XM operates in the Vietnamese market, it is under the management of IFSC, the license this company grants has weaker influence than the other two companies, so it can ensure all benefits. For traders, it may be weaker, but XM has also received a license from CySEC and ASIC, proving that XM is always trying to develop and increasingly assert its solid position in the market.

XM trading platform

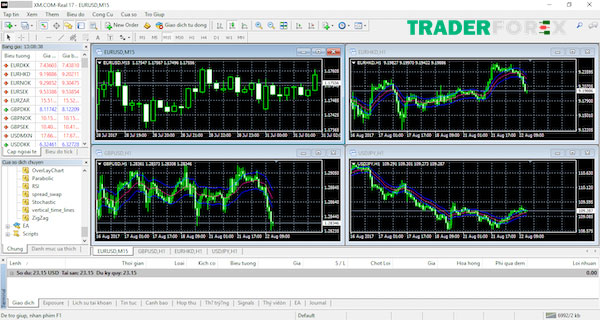

One of the next advantages that makes XM chosen by many traders is its trading platform from MT4. MT 5 and is compatible with many operating systems.

MT4 is powered by XM

For investors in the Forex market, MT4 is no longer strange and is the top choice of many traders because it is easy to use and has quick, automatic customer support. orders can be executed easily.

Main features of MT4 on XM platform

- Currently, there is the ability to integrate many products such as Forex, CFDs and tends to continue to increase in the future

- Able to synchronize with many different trading software

- Low spreads from only 0.6 pips

- Tools used for technical analysis are diverse with many indicators and charts

- Chart types: Line, bar, candlestick

- It is allowed to execute commands symmetrically and in opposite directions

- Installed indicators and set up different periods and time frames

- Data is kept safe and stored

MT5 is powered by XM

Metaquotes Company has upgraded MT4 to MT5 to be more scalable and easier for users, helping investors have more multi-layer trading cards and more outstanding advantages. Chart types and support tools also have greater flexibility and automation, capable of specializing in transactions.

Normally, MT4 has order types such as: Buy stop/limit and sell limit/stop, the MT5 version has been upgraded and has additional buy stop limit and sell stop limit orders, which helps investors have a higher probability of success. Higher trading success, can trade with robot programming and have indicators installed that are suitable for each different person.

Besides, this upgraded software also has the outstanding advantage of stock trading, but to be able to perform this type of transaction, investors need to open an MT5 account.

Main features of MT5 on XM platform

- MT5 is capable of integrating more than 1000 different trades including stocks, stock indices, Forex, energies and metals

- Able to synchronize 7 different products

- Low spreads from only 0.6 pips

- For technical analysis subjects MT5 can provide more than 80 tools

- With 100 different charts, MT5 is still capable of displaying them all

- Many technical indicators ( 80) and objects for analysis ( 40)

- Can execute many different types of orders

Hedging at XM

At XM, there are reciprocal orders to buy and sell. The role of hedging is to evaluate the above orders at the same time. Traders love this method, but if you are a new investor who is still unfamiliar with the trading floor, you should not use it because it brings very high risks to you.

On all exchanges, Hedging is best used on XM floor because this floor has a Close by order, two orders with opposite directions can be closed at the same time with a Close by and this helps investors. Investing can save a significant amount of money. And note that to be able to use close by, you should close the Buy and Sell orders at the same time.

In addition, there is another order that can be used on both MT4 and MT5, which is Multiple Close by, which has a feature that allows you to close multiple orders in opposite directions at the same time.

MT4 Multiterminal

With Multiterminal, through just one software, one login to the software, investors can easily manage multiple MT4 accounts. The superior features of this software are as follows:

- Can execute many types of orders and many different account types up to 128 accounts

- Perform allocation with 3 methods

- Implement management and enforcement according to specific time frames

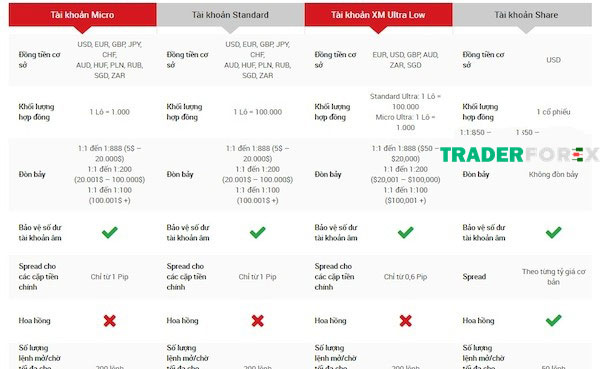

Types of trading accounts on XM

XM's main account types are micro, standard, Ultra and share. We will learn about these asset types shortly.

Micro account

- The minimum deposit is 5 USD

- Spread cost is 1 pip

- There are no commission fees

- There are at least 200 open or pending orders

- For MT4 the minimum order volume is 0.01 and 0.1 for MT5

- There is a trading bonus percentage

This is the optimal choice for new investors without much experience and is similar to FBS and Cent accounts.

This type of account is calculated in a unique way for Micro Lot as follows: If by normal standards 1 Lot is converted into 100,000 units, then for Micro Lot 1 lot is only equal to 1000 units. That's why the lot size here has a very small transaction size, no matter how large the amount displayed on XM is, so investors are guaranteed risk.

Standard account

- The minimum deposit is 5 USD

- Spread cost is 1 pip

- There are no commission fees

- There are at least 200 open or pending orders

- For MT4, the minimum order volume is 0.01 lot

- There is a trading bonus percentage

This account is similar to Micro, the only difference is that this account converts lots in standard units and the maximum leverage is 1:888. The customers of this type of account are also new investors, creating the best conditions for new traders to trade.

Ultra Low Account

- Spread costs are 0.6 pips for major currency pairs.

- The minimum deposit is 50 USD

- There is a maximum of 200 open or pending orders

- There are no commission fees

This account type is suitable for traders with a surfing style.

XM uses this type of account to compete with other reputable trading floors such as: ECN, ICMarkets, Exness… And this type of account also has many attractive incentives to attract customers. However, Standard is divided into two subtypes: Standard and Micro, with differences in transaction volume.

Share account

- The minimum deposit is 50 USD

- Do not use leverage

- Spread costs depend on each type

- There are at least 200 open or pending orders

- Minimum 1 lot order

- And lose commission fees

This is the favorite account type for stock trading enthusiasts, but the minimum deposit amount must be over 10,000 USD and that is also the reason why this account cannot have leverage. For standard conversion, to have 1 trading lot you need 100,000 USD, a very high level. That's why this type of account cannot compete with XTB and ICMarkets because with these two account types, customers can enjoy 1:20 leverage.

Note about the above account types

Customers can open 8 different types of accounts at the same time on XM, so they encounter cases where XM implements an inactive account policy (no transactions, money transfers, deposits and withdrawals…) and for this type If this account is inactive, all rewards and credit benefits will be automatically deleted. In addition, it is charged monthly and each month is 5 USD and the maximum storage period is 90 days.

Learn detailed steps to open an XM account here.

XM trading products

- 57 currency pairs in the forex market

- 1184 stock CFD codes

- Trading on Share has 100 types of stocks

- 8 types of goods

- 30 stock indexes

- 4 precious metal products

- 4 energy products

With a diverse product range, investors have many choices and enjoy dividends when participating in stock and securities transactions, which is XM's great competitive advantage.

Transaction fees

This is also the top concern of investors during transactions because it greatly affects their interests.

Spread costs for account types in XM are quite small, fluctuating below 0.6pip in major currency pairs and fluctuating at 1pip for standard and micro accounts. Customers will receive this price directly from the market and there will be no re-quote phenomenon

Financial leverage : ranges from 1:1 to 1:888. The minimum limit of Standard and Micro accounts is 5 to 20000 USD and 50 to 20000 USD for Ultra Low..(leverage from 1:1 to 1:200 Trader's account has 20001 to 100000 USD, leverage from 1:1 to 1:100 Trader's account has more than 100001 USD, and the account without financial leverage is Share).

Commission fee : only share accounts will incur commission fees for stock transactions, the remaining accounts will not incur commission fees of any kind.

Detailed review of Liteforex platform cannot be missed.

Resources provided by XM

Trading signals

There are many types of signals such as signals analyzed by XM, signals from expert Avramis Despotis, human resource training expert for many banks, news agencies…

Signals analyzed by expert Avramis Despotis include 10 products such as: USD/ EURO, GOLD, OIL, GBP/USD… with all stop loss and profit point orders. You will receive this signal as soon as you register a member account and authenticate it.

Besides, you can also get these signals by: Go to your account and log in, then click Technical Analysis

The main indicator was developed by XM

XM always has a large team of experts to develop and upgrade indicators, and one of the indicators upgraded by XM is the Ribbon Indicator, which helps detect trends very well and can also predict reversals. .

Educational resources

XM has many detailed instructional videos on how to use MT4 and MT5 and many issues related to this trading platform. Invite experts to guide traders in trading at XM and organize seminars to impart information, support investors in making transactions in the best way and you will experience the This is free when you register an account.

Promotions on XM

When registering for an XM account, you will receive a bonus of up to 30 USD

For customers who join XM for the first time, they will immediately receive the bonus as soon as their account is verified without having to do anything. The steps to get your reward card are as follows:

- Create an XM account

- Keep proof of identity and address to authenticate your account

- Click to request reward

- Complete confirmation according to instructions

After completing the above steps you will receive a 30 USD bonus. To withdraw this amount you need:

- Trade at least 0.1 lot of standard volume

- Trade at least 5 orders

Welcome bonus 15%

You will receive this bonus when you deposit money into your account, and within 24 hours from the time of depositing, you will receive an amount equal to 15% multiplied by the amount you deposited and the maximum amount that you get at 500 USD. And with this money you can only use it to help you manage risks better, you cannot withdraw it and the first two types of accounts, XM Ultra Low and second, XM Shares Account, will not be accepted. receive this type of bonus.

Celebrating XM's 10th anniversary

This type of bonus will be conducted by XM in the form of a lottery and you will receive a spin when you have one of two types of MT4/MT5 accounts and have a prescribed balance of 500 USD and will take place on the date celebrates its 10th anniversary in August 2020.

Free VPS

To get free VPS you need to have at least 2 standard monthly transactions and need to maintain an account balance of 500 USD. And vice versa, if you do not satisfy the above two requirements, you will have to pay 28 USD for VPS fee every month.

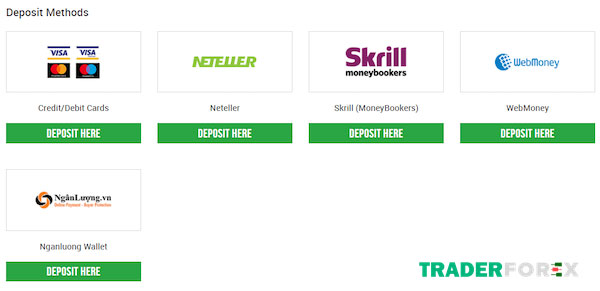

How to deposit and withdraw money at XM

But customers can make this transaction through electronic payment gateways 24/7 quickly and receive full cost support when making via visa, mastercard… but you need to transact with a number. You can trade for free from 200 USD, otherwise you will have to pay the fee yourself. Within 24 hours, these transaction requests will be confirmed and processed and money will be received the same day when using XM cards, e-wallets or it will take longer if it is a debit card or bank transfer.

Customer care

XM has a team dedicated to serving and answering customer questions 24/5 through many contact forms such as email, chat or direct phone consultation. Each customer and each account has its own manager. Customers contact this separate manager for technical handling and to receive information about training sessions on XM, MT4, MT5…

Questions about XM floor

Minimum and maximum amount to deposit/withdraw?

The minimum deposit and withdrawal amount at XM is 5 USD (or corresponding monetary values) applicable to many deposit and withdrawal methods and support in all countries. But the deposit and withdrawal methods you choose and depending on the authentication status of your trading account may change.

How long can I use a Demo account at XM?

Demo accounts at XM do not have an expiration date, so you can use them for as long as you want. However, 90 days from your last login date at XM, the account will be closed. You can open additional Demo accounts, but the maximum number of active Demo accounts is 5.

What are XM's trading hours?

The market is open from Sunday 22:05 to Friday 21:50 GMT. However, for some trading products, there will be other trading hours such as CFDs.

XM floor review

Advantages of flooring

- Ensuring prestige and professionalism when licensed and managed by many large financial houses

- On the same account, you can integrate both Forex and CFD

- Traders who like to make trades related to stocks can create their own account

- Besides stocks, XM does not charge commissions on any type of product

- Lowest loading level

- Fast withdrawal/deposit transactions and fee support

- Many promotions to thank customers

- There are many trading signals shown

Defect

- For stocks, the cost is high and there is no leverage

- Cannot trade with cryptocurrencies

We can see that this is a trading platform that is quite perfect for traders and seems to be perfect. But in reality, when using it, traders have realized many limitations as follows:

Order matching speed: One of XM's priority policies is not to re-quote prices and not refuse orders. The translation cannot specifically explain this implementation nor can it be verified.

It is unclear the nature of the exchange that is conducting the transaction and it is unclear who the liquidity provider is.

In reality, other exchanges will collect commission fees and have no intervention in spreads, but XM does the opposite, so it is unclear what the development policy of this market is.

XM only has minor and insignificant limitations and in general this is a reputable trading platform that traders can trust. XM is always developing and constantly trying to improve itself to best serve customers.

Frequently asked questions about XM floor

To help investors better understand XM floor and have enough confidence when participating in financial transactions with this floor, let's learn in detail the basic questions that are of most concern. XM floor.

What do investors need to join XM?

XM is a forex trading platform that provides effective trading products for investors. To participate in trading on this exchange, you need the following documents:

- A color copy of a valid passport or other government-issued identification document (driver's license, ID card, etc.).

- Identification information must include the customer's name, date of issuance or expiration, and city of residence.

- Date of birth or tax code and signature.

- Electronic utility bill (e.g. electricity, gas, water, landline, oil, internet and/or cable TV, bank statement) issued within the last 6 months. It may contain your registered address.

What do I need to prepare to verify my XM account?

As a company strictly managed and supervised by corporations and financial institutions, XM operates and is directly managed in compliance with a number of relevant regulatory documents and rules issued by regulatory agencies. applied and under the direct control of FSC.

This includes collecting valid ID card and utility bill or bank statement, current bank account (within 6 months), verification of customer's registered address, KYC, includes obtaining appropriate documentation from the customer.

Does it take long to create an XM account?

Perhaps this question is the issue that many people are most interested in today. Using and creating an XM account is so easy that investors can quickly create an XM trading account in just 5 minutes including procedures and personal information verification. The process is very easy, easy for anyone to do.

Is XM floor safe?

XM platform is one of the most prestigious and reliable forex products today. XM is operated and managed directly by XM Global Limited. XM Global Limited will ensure all trading operations are safe for your funds and protect them in accordance with applicable laws and regulations. Accordingly, the measures applied by XM include:

- Customer money distribution policy: Customer money is transferred directly to the customer's bank account at another company. These funds are removed from the balance sheet and cannot be used to repay debt if the company encounters financial difficulties or goes bankrupt.

- Bank accounts: XM Forex Broker always separates client accounts and active accounts with trusted banking institutions.

- Regulatory Oversight: As an investment services licensee, we are subject to strict financial requirements. XM Exchange is required by law to maintain sufficient working capital to cover customer deposits, potential fluctuations in currency orders and all other expenses. In addition, an independent audit department conducts annual audits of the company's financial statements.

What should XM users do if they lose their bonus?

In many cases where investors receive bonuses from the exchange but unfortunately lose money, the question is whether the previous bonus can be used to offset losses or not? You can lose the bonus because it is part of your capital and of course this money will also be used for trading. However, investors also do not have to repay lost bonuses. You can also get a new bonus by depositing more money according to the terms and conditions of the bonus.

What type of Forex broker is XM?

XM is a financial brokerage that plays an important role in creating markets, providing trading services for financial products through providing ‘bid' and ‘ask' quotes on trading platforms. online translation.

How long has XM been operating in the industry?

Since 2009, XM has been a group of regulated online brokers operating in the financial industry.

Is XM licensed (permitted to operate) and controlled?

With licensing and control from reputable regulatory authorities in the regions in which they operate, XM ensures that their operations comply with the necessary regulations and standards. XM Global Limited is a typical example when controlled and licensed by the Financial Services Commission (FSC) of Belize with license number 000261/309.

Where is the headquarters of XM trading platform located?

XM is headquartered in Belize City, Belize, where contact details are available to help customers access their services at their convenience. Besides, XM also has representative offices in many cities around the world.

With the information shared in this article, you will have a new perspective on the Forex market and learn more about a new reputable Forex trading platform , XM , so you can choose the most suitable trading platform for you. .

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?