Why is it important to know where your broker subsidiary (entity) is regulated?

Different regulators provide different levels of protection. For example, OCTA clients in the European Union benefit from the oversight of the Cyprus Securities and Exchange Commission (CySEC). CySEC requires that clients have negative balance protection, which means they cannot lose more than their deposit.

In addition, when trading with a broker authorized by CySEC, client funds are protected by the Investor Compensation Fund (ICF). ICF protects client accounts for up to €20,000 if a firm becomes insolvent. A trader working with a broker entity regulated offshore would not necessarily have these benefits.

The table below lists the protections and benefits by entity, regulator, and region.

| Entity | Octa Markets Cyprus Ltd | Octa Markets Inc. | Octa Markets ltd. | Orinoco Capital (Pty) Ltd. |

| Country/Region | European Union | Global | Global | South Africa |

| Regulation | Cyprus Securities and Exchange Commission | Registered, regulated, and governed by the law of Saint Lucia | Mwali International Services Authority | Financial Sector Conduct Authority (FSCA) |

| Segregated Funds | Yes | Yes | Yes | Yes |

| Negative Balance Protection | Yes | Yes | Yes | Yes |

| Compensation Scheme | ICF Up to €20,000 | No | No | No |

| Maximum Leverage | 1:30 | 1:500 | 1:500 | 1:500 |

Regulatory requirements are subject to change. We gathered the data listed above in June 2023.

Stability and Transparency

In our tests for the Trust category, we also cover factors relating to stability and financial strength. Here, we focus on how long the broker has been in business, what is the company size, and how transparent the broker overall.

Launched in 2011, OCTA has a substantial operating history. According to the company’s LinkedIn page, the Saint Vincent and Grenadines-based broker has over 51-200 employees, reflecting a medium-sized brokerage firm.

The EU entity of OCTA clearly states its regulatory status in the website’s footer. The offshore entity also references its corporate registration number with the Saint Lucia authorities at the bottom of each page. However, there is room for improvement in terms of being clear about the unregulated status of the offshore entity.

Trading costs such as spreads are clearly explained on the Spreads and Conditions page. To read the fine print, traders can find the Customer Agreement in the footer of the website. The About Us page does a good job of sharing the company’s mission and history through a series of milestones over the years. Overall, I rate OCTA as having a mixed level of transparency.

Fees

4.6How Did We Test the Broker's Fees and Commissions?

How Did We Test The Broker's Fees And Commissions?

Broker commissions and fees can be challenging to understand. To simplify this for you, we carefully examined all the broker's fee-related documentation and presented it in a clear, easy-to-understand format. Furthermore, we conducted hands-on tests on spreads and commissions for the most common instruments during both London and New York trading sessions. We then compared these real-time test results to the market benchmark we've established through our extensive experience evaluating the industry.

OCTA excelled in the category of fees, with tight spreads in CFDs on forex and shares. It also bucks the industry trend by not charging swaps or inactivity fees. For both trading accounts (OctaFX MT4 and OctaFX MT5), all fees are reflected in the spread – there are no additional commissions charged.

Trading Fees

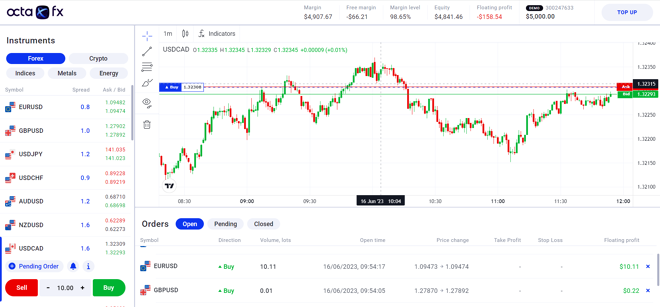

I tested the spreads at OCTA across different assets using the MetaTrader 5 platform at 8:00 a.m. GMT and 4:00 p.m. GMT on 19 June 2023.

Measuring spreads at different times of the day allows for greater perspective: 8:00 a.m. GMT is the London open when there is high liquidity in the forex market. 4:00 p.m. GMT is during the New York trading session.

| Instrument | Spread AM | Spread PM |

| EUR/USD | 1 Pip | 0.8 Pip |

| GBP/JPY | 1.4 Pips | 1.2 |

| Gold | 23 Pips | 22 Pips |

| Light Crude Oil | 7 Pips | 8 Pips |

| Apple | n/a | 18 cents |

| Tesla | n/a | 27 cents |

| Dow 30 | 4 Pips | 4 Pips |

| Dax 40 | 2 Pips | 2 Pips |

| Bitcoin | $14.67 | $16.35 |

Swap Fees

OCTA does not currently charge swap fees – the charge for holding leveraged positions overnight.

Non-Trading Fees

OCTA does not charge an inactivity or account maintenance fee.

Are Fees at OCTA Competitive?

I rated fees at OCTA as competitive for the following reasons:

- I experienced highly competitive spreads in forex, gold, and shares. Indices were closer to the industry average.

- Unlike most CFD brokers, OCTA does not charge swap fees.

- OCTA does not charge commissions on CFDs on shares (or any other instrument).

- OCTA does not charge any inactivity or account maintenance fees.

Platforms and Tools

4.5How Did We Test the Broker's Trading Platforms?

How Did We Test The Broker's Trading Platforms?

We understand that platforms play a crucial role in your trading experience. That's why we spent many hours testing the broker's web, desktop, and mobile trading platforms to gain a real understanding of their usability, functionality, and overall performance. From experimenting with different order types to testing execution speeds, charting, and other features, we thoroughly examined every aspect of these platforms based on our trading expertise, helping you make an informed choice.

OCTA offers the popular MetaTrader 4 and MetaTrader 5 platforms across desktop, web, and mobile. These platforms provide robust charting and a wide range of order types and enable automated trading. The web-based OctaTrader platform is a beginner-friendly and convenient alternative.

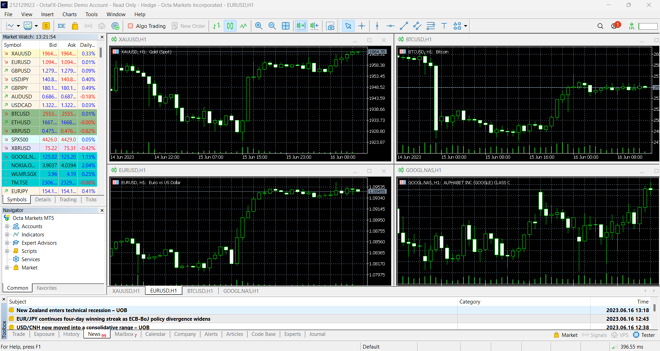

MetaTrader 5 Desktop

In the hands-on testing process, I used MetaTrader 5 for desktops, which includes advanced functions such as copy trading and automated trading.

MetaTrader 5 Desktop Platform

MetaTrader 5 is available in 52 languages, from Arabic to Vietnamese. The platform provides popular features such as

- Alerts. This feature updates traders when an instrument reaches a specific price level.

- Watchlists. Traders can create a list of their favorite instruments and follow live quotes in a market watch panel.

- One-Click Trading. This feature allows traders to execute orders with a single click and no secondary confirmation. This feature enables traders to operate faster and is especially useful for short-term traders.

- Trading from the Chart. MT5 also allows users the convenience of trading directly from the chart.

MetaTrader also delivers when it comes to the range of available order types. The platform offers the following order types:

- Market Order. Traders use market orders to buy or sell an instrument at the best current price.

- Limit Order. Traders use limit orders to buy or sell an instrument at a specified price or better.

- Stop Loss Order. Traders use stop-loss orders to buy or sell an instrument when its price reaches a specified level.

- Stop Limit Order. Traders can manage risk more precisely with stop limit orders, which combine the features of a stop-loss with those of a limit order.

- Trailing Stop Order. Traders use trailing stop-loss orders as a stop-loss order at a defined percentage or dollar amount away from an instrument’s current market price. This order type allows traders to secure profits when they are in a winning trade while not having to exit the position.

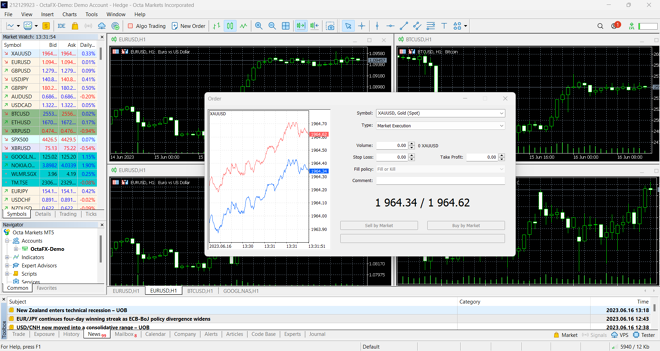

Order Entry on the MetaTrader 5 Platform

Charting features are robust. MetaTrader 5 offers:

- 38 Technical Indicators. These include classic trend indicators, volume indicators, and oscillators.

- 44 Analytical Objects. These include lines, channels, Gann, and Fibonacci tools.

- 21 Time Frames. Traders can choose from nine time frames, from one minute to one month.

- 3 Chart Types. Traders can use Bar Charts, Japanese Candlestick Charts, and Line Charts.

Charting on the MetaTrader 5 Platform

MetaTrader is also popular due to its copy trading and automated trading features.

- Trading Signals. Signals in MetaTrader 5 allow users to copy other traders’ activity in real time.

- Automated Trading. MetaTrader 5 allows users to develop, test, and apply Expert Advisors (EAs). EAs are programs that monitor and trade markets using algorithms.

The MetaTrader 5 desktop platform is one of the most feature-rich and popular trading platforms. However, it may present a steep learning curve for beginners.

MetaTrader 5 Web

The MetaTrader 5 Web Platform (Web Trader) is a slightly stripped-down version of the desktop platform. It allows you to trade without any additional software, only an internet connection is required. The Web Platform allows users to trade directly from any browser and operating system.

OCTA MetaTrader 5 Web Platform

Popular features include

- One-click trading

- Trading from the chart

- Watchlists with real-time quotes

- Trade History

- Advanced charting with 30 indicators for technical analysis

Copy and automated trading are only available on the MT5 desktop platform.

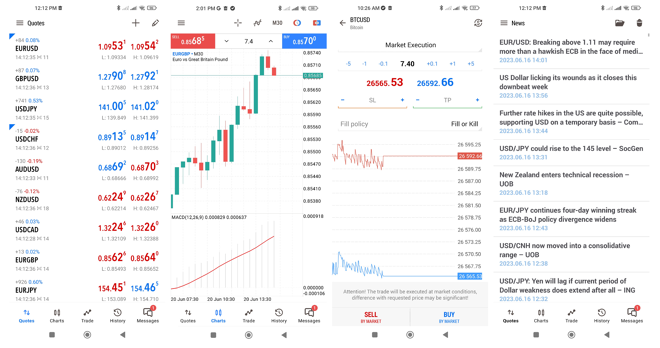

MetaTrader 5 Mobile App

OCTA offers the MetaTrader 5 mobile app for mobile trading, which is available for Android and iOS. The app offers popular features such as alerts, 1-click trading, and trading from the chart.

OCTA MetaTrader 5 Mobile App

The MetaTrader 5 mobile app also provides many order types, including pending and stop orders. However, trailing stop-loss orders are only available from the desktop. To change the language of the MT5 app, you must change the language for your entire phone. As with the desktop and web platforms, the interface is not highly intuitive, but the MT5 app offers an above-average range of features.

MetaTrader 4 vs. MetaTrader 5

OCTA offers both MetaTrader 4 and MetaTrader 5. MT5 provides a greater number of technical indicators, timeframes, and graphical objects. It also has additional features such as an economic calendar. The table below highlights the main differences.

| Feature | MetaTrader 4 | MetaTrader 5 |

| Technical Indicators | 30 | 38 |

| Charting Time Frames | 9 | 21 |

| Analytical Objects | 31 | 44 |

| Pending Order Types | 4 | 6 |

| Platform Languages | 39 | 52 |

| Economic Calendar | No | Yes |

| Strategy Tester | Single-threaded strategy tester | Multi-threaded strategy tester* |

*The multi-threaded strategy tester in MT5 allows traders to backtest a trading strategy on multiple financial instruments simultaneously.

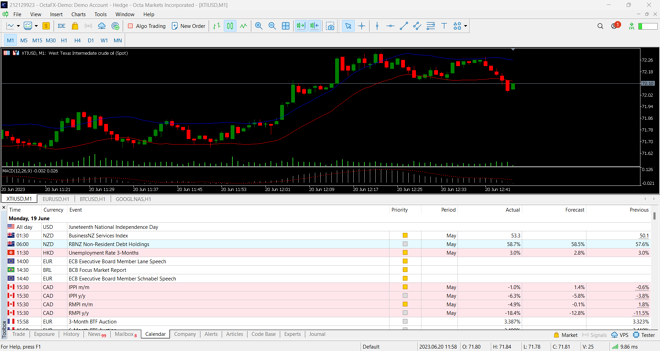

Economic Calendar within the MT5 Desktop Platform

OctaTrader Platform

The web-based OctaTrader platform is well-designed and intuitive. Popular features such as 1-click trading, alerts, and watchlists are available. Traders can access all basic order types (market, limit, stop loss) via the platform.

Robust charting is provided by TradingView, featuring 11 time frames, 11 chart types, and over 100 technical indicators. Various drawing tools, from trend lines to Fibonacci retracements, are also available.

OctaTrader Platform

OctaTrader can be used in the following languages: English, Hindi, Urdu, Spanish, Arabic, Malay, Indonesian, Malay, Chinese, Portuguese, Thai, Deutsch, Bengali, Vietnamese, and Turkish.

Copy Trading

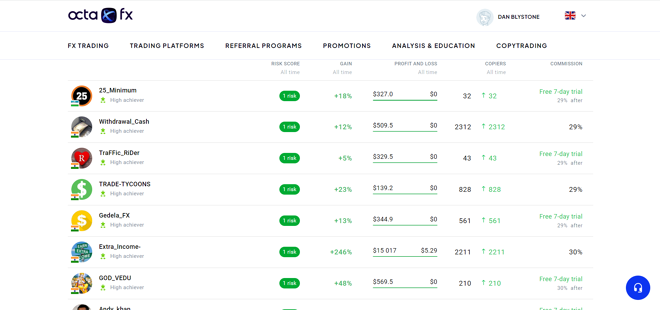

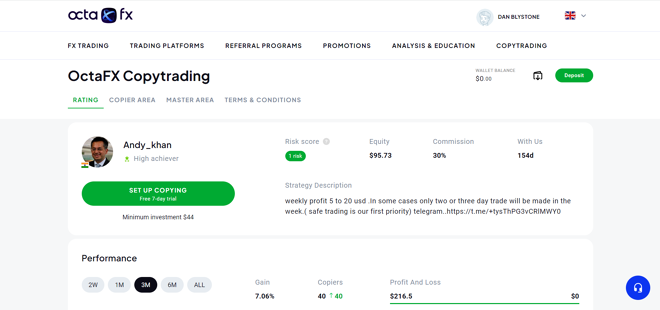

OctaFX copy trading enables clients to automatically copy experienced traders, and piggyback on their expertise in the markets. Traders can browse and select the ‘Master Traders’ they want to follow by looking at statistics such as:

- Percentage gains (this can be viewed across different time periods, from two weeks to six months).

- The number of copiers.

- Maximum Unrealised Loss (the largest unrealized loss the Master Trader held within all their open orders at one point in time).

- Maximum Drawdown Duration (the largest timespan the Master Trader’s ‘floating profit’ was negative).

OctaFX Copy Trading

By pressing ‘set up copying’, the orders of the Master Trader will be copied automatically. Traders have complete control over the process and can stop copying anytime. OCTA clients with an MT4 account can also elect to become Master Traders. They can then trade as usual and earn additional income whenever others choose to copy them.

OctaFX Copy Trading Rating Page

Tradable Instruments

4How Did We Test the Broker's Tradable Instruments?

How Did We Test The Broker's Tradable Instruments?

For this section, we examined the broker's market offering, assessing the variety and depth of instruments and asset classes available for trading. Through our proprietary database, we then compared the results with other brokers. This comprehensive analysis allows you to determine if the broker offers the specific instruments and trading options you're looking for.

OCTA offers a variety of trading instruments, including CFDs on all the major asset classes— forex, commodities, indices, shares, and cryptocurrencies. OCTA has a strong selection of CFDs on cryptocurrencies, numbering 30 in total. The range of available CFDs on indices is also better than average.

CFDs (Contracts for Differences) are financial derivative products that allow traders to speculate in various markets without owning the underlying assets. I rated the range of tradable instruments at OCTA as slightly better than average. Here are the major categories of tradable assets available at OCTA:

- 35 Currency Pairs. A currency pair combines two different currencies, with the value of one currency quoted against the other. For example, EUR/USD, which reflects the value of the euro measured in dollars.

- 5 Commodities. Commodities are raw products, such as gold and oil.

- 150 Global Stock CFDs. OCTA offers trading in stock CFDs from exchanges ranging from the NASDAQ to the Australian stock exchange. A stock is a security that represents partial ownership of a corporation.

- 10 Indices. Available instruments range from French to Japanese stock indices. An index is a basket of trading instruments that are used to gauge a market sector, stocks within an exchange, or the economy of a country.

- 30 Cryptocurrency CFDs. Cryptocurrencies, such as Bitcoin, are digital currencies that are secured by cryptography.

In the tables below, you can see a selection highlighting the variety of instruments available at OCTA:

| Forex Major | Forex Minor |

| USD/CHF | GBP/USD | USD/JPY | EUR/NZD | GBP/JPY | EUR/CAD |

| Metals | Energy |

| Silver | Gold | Natural Gas | WTI Crude Oil | Brent Crude Oil |

| Shares | Indices |

| Amazon | Starbucks | Adidas | SPX500 | AUS200 | NAS100 |

| Crypto |

| Bitcoin | Polkadot | Cosmos | Dogecoin | Binance | Solana | Ethereum |

OCTA Maximum Leverage by Asset Class

Available leverage differs according to the asset class, with the most leverage available with CFDs on forex and the least with CFDs on shares.

The figures below reflect the available leverage at the offshore entity of OCTA.

| Asset Class | Maximum Available Leverage |

| Forex | 1:500 |

| Metals | 1:200 |

| Energies | 1:100 |

| Indices | 1:50 |

| Cryptocurrencies | 1:25 |

| Shares | 1:20 |

Customer Support

4How Did We Test the Broker's Customer Support?

How Did We Test The Broker's Customer Support?

Traders often underestimate the importance of customer support, yet it proves to be a critical aspect during times of crisis. We put the broker's customer support to the test ourselves using all possible channels, such as chat, phone, and others. Our evaluation focused on the accessibility of live agents, as well as the helpfulness and professionalism of their responses. This way, we provide you with comprehensive insights into whether a broker can deliver full support when you need it most.

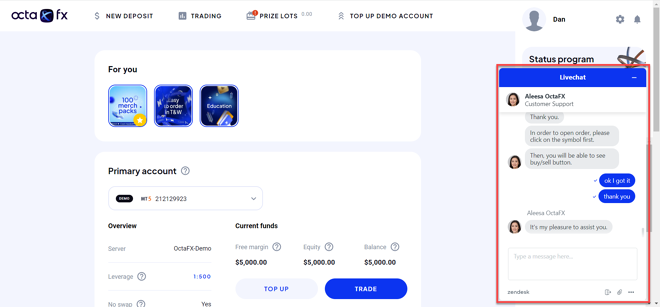

OCTA provides 24/7 customer support via live chat and email. Phone support is not currently available. In my tests, I received speedy responses—the same day for email and a wait of just a few seconds for live chat. The agents were helpful and attentive. Despite the lack of phone support, I rate OCTA as average in this category.

OCTA’s customer support is available in 28 languages, including English, Hindi, Urdu, Spanish, Arabic, Malay, Indonesian, Malay, Chinese, Portuguese, Thai, Deutsch, Bengali, Vietnamese, and Turkish.

OCTA Live Chat Support

OCTA Customer Support Test

Over a week-long testing period, I probed customer support with dozens of inquiries, ranging from available tools to fees and questions relating to the security of client accounts. I was surprised at how fast the responses were, and the agents went the extra mile to provide the information I sought.

Deposits & Withdrawals

5How Did We Test the Broker's Deposit and Withdrawal Process?

How Did We Test The Broker's Deposit And Withdrawal Process?

The deposit or withdrawal process can be tricky since you may encounter hidden fees or longer than expected processing time. To assess the broker's offerings, we examined their deposit and withdrawal options and conditions. Using our proprietary database, we then compared these results with those of other brokers.

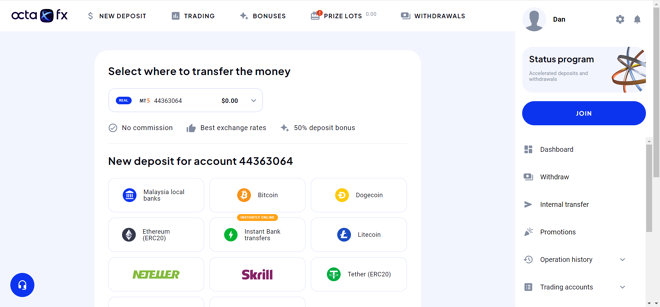

OCTA clients can make deposits and withdrawals via bank wire, credit card, digital wallet, and cryptocurrency. Available methods vary depending on where you reside. No fees are charged for deposits or withdrawals. Processing times range from instant to a few hours, which is better than average for the industry.

OCTA Deposits and Withdrawals

In the tables below I break down the fees and processing times for each deposit and withdrawal method.

Deposits

| Deposit Method | Fees | Processing Time |

| Local Bank Wire | $0 | 1-3 hours |

| Instant Bank Transfer | $0 | Instant |

| Visa | $0 | 1-5 minutes |

| Neteller | $0 | Instant |

| Skrill | $0 | Instant |

| Bitcoin | $0 | 3-30 minutes |

| Dogecoin | $0 | 3-30 minutes |

| Ethereum (ERC20) | $0 | 3-30 minutes |

| Litecoin | $0 | 3-30 minutes |

| Tether (ERC20) | $0 | 3-30 minutes |

| Tether (TRC20) | $0 | 3-30 minutes |

Withdrawals

| Withdrawal Method | Fees | Processing Time |

| Local Bank Wire | $0 | 1-3 hours to approve the withdrawal and up to 1 hour to transfer the funds |

| Visa | $0 | 1-3 hours to approve the withdrawal and up to 1 hour to transfer the funds |

| Skrill | $0 | 1-3 hours to approve the withdrawal and up to 5 minutes to transfer the funds |

| Neteller | $0 | 1-3 hours to approve the withdrawal and up to 5 minutes to transfer the funds |

| Bitcoin | $0 | 1-3 hours to approve the withdrawal and up to 30 minutes to transfer the funds |

| Dogecoin | $0 | 1-3 hours to approve the withdrawal and up to 30 minutes to transfer the funds |

| Ethereum (ERC20) | $0 | 1-3 hours to approve the withdrawal and up to 30 minutes to transfer the funds |

| Litecoin | $0 | 1-3 hours to approve the withdrawal and up to 30 minutes to transfer the funds |

| Tether (ERC20) | $0 | 1-3 hours to approve the withdrawal and up to 30 minutes to transfer the funds |

| Tether (TRC20) | $0 | 1-3 hours to approve the withdrawal and up to 30 minutes to transfer the funds |

Account Types and Terms

3.8How Did We Test the Broker's Account Types and Terms?

How Did We Test The Broker's Account Types And Terms?

When it comes to achieving your trading goals, choosing the proper account is essential. We initiated our evaluation by personally opening an account with the broker, which allowed us to gain firsthand experience of the process and accurately asses, how fast and easy it is. In addition, we carried out an in-depth analysis of the account types and features offered by the broker, including spreads, maximum leverage, minimum deposits, and more. For a comprehensive comparison, we turned to our proprietary database and examined how this broker's account offerings and processes stacked up against other brokers.

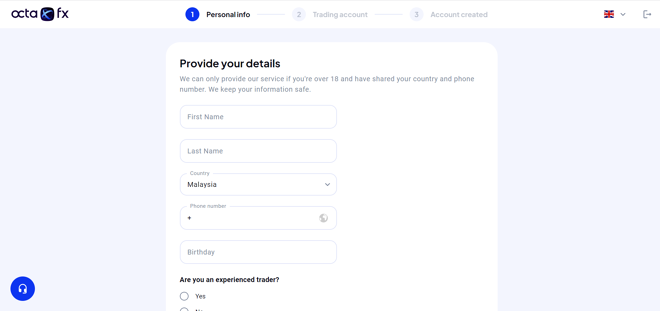

The account opening process at OCTA is fully digital and can be completed within minutes via the company website. The broker offers three main account types; OctaFX MT4, OctaFX MT5, and OctaTrader. The score for this category was weighed down because only one base currency is available (USD) and there is no option for a raw spreads account.

Account Application

To open an account at the Octa Markets Inc. entity, follow the next steps:

- Press the button “Create an account” on the website’s homepage.

- Enter your email and create a password.

- After confirming their email, enter your name, country of residence, and phone number.

- Provide information about your trading experience.

OCTA Account Application

Account Types

OctaFX offers three main account types: OctaTrader, MetaTrader 4, and MetaTrader 5.

Account Types Comparison

| Account | OctaFX MT4 | OctaFX MT5 | OctaTrader |

| Spread | Floating, starting at 0.6 pips | Floating, starting at 0.6 pips | Floating, starting at 0.6 pips |

| Recommended Deposit | 25 USD | 25 USD | 25 USD |

| Available Instruments | 35 currency pairs + gold and silver + 3 energies + 4 indices + 30 cryptocurrencies | 35 currency pairs + gold and silver + 3 energies + 10 indices + 30 cryptocurrencies + 150 stocks | 80 Instruments: 35 currency pairs + gold and silver + 3 energies + 10 indices + 30 cryptocurrencies |

| Available Leverage | 1:500 for currencies (1:100 for ZARJPY) 1:200 for metals 1:100 for energies 1:50 for indices 1:25 for cryptocurrencies | 1:500 for currencies (1:100 for ZARJPY) 1:200 for metals 1:100 for energies 1:50 for indices 1:25 for cryptocurrencies 1:20 for stocks | Forex 1:500 (ZARJPY 1:100) Metals 1:200 Energies 1:200 Indices 1:200 Crypto 1:100 |

| Minimum Volume | 0.01 lot | 0.01 lot | 0.01 lot |

| Maximum Volume | 200 lots | 500 lots | 50 lots |

| Deposit Currencies | USD or EUR | USD or EUR | USD |

Demo Accounts

Demo accounts are especially important for beginners as they allow them to practice their strategies and get comfortable with the trading platform without risking real money. OCTA offers demo accounts for MetaTrader 4 and MetaTrader 5.

The demo account features live quotes and simulates live market conditions in assets such as forex and CFDs on commodities, indices, and stocks. Once users have gotten up to speed on a demo account, they can easily switch to a live version.

Islamic Accounts

OCTA offers a swap-free Islamic account that adheres to the principles of Sharia law.

Leverage

One of the reasons that traders are attracted to the forex and CFD markets is the high degree of available leverage. Leverage is the use of borrowed funds to increase the size of your trading positions beyond what would be possible using only the cash in your account.

The maximum leverage at the global entity of OCTA is 1:500. This means that with an account of $1,000, you can control up to $500,000 worth of positions in the market. Leverage is often described as a ‘double-edged sword’ as it can hurt you as much as it helps you. Traders must remember that it can amplify both their profits and their losses.

Order Execution

OCTA is an STP/ECN broker. Client orders received by OCTA are offset by banks and liquidity providers. NDD (No Dealing Desk) brokers such as OCTA act as intermediaries between the trader and the real market and receive a defined and transparent commission for it.

Supported Countries

OCTA takes clients from the majority of countries globally. However, clients not accepted from American Samoa, Belarus, Cyprus, Guam, Kazakhstan, Northern Mariana Islands, Puerto Rico, Russia, Ukraine, United States Virgin Islands, United States, United States Minor Outlying Islands, and the Marshall Islands.

Research

4.8How Did We Test the Broker's Research Tools?

How Did We Test The Broker's Research Tools?

Research options offered by brokers may not be seen as the most important feature for some traders, but they can provide a competitive advantage. To assess the broker's research offerings, we personally explored and tested both proprietary and third-party tools and content, such as Fundamental and Technical Analysis, Market News, educational videos, and webinars. After evaluating the availability and quality of the overall research offering, we compared the results with our benchmark to provide a comprehensive analysis of the broker's research capabilities.

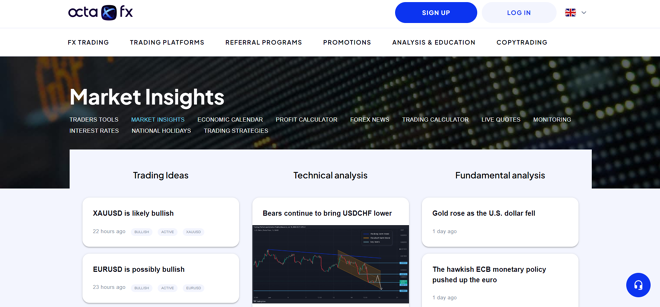

OCTA excels in research, offering regularly updated commentary written by in-house analysts and trading ideas. In addition, clients can utilize research from third-party provider AutoChartist. I rate OCTA as better than the industry average in this category.

Daily and weekly forecasts in the Market Insights section preview the key economic data ahead and highlight the major market movers. The reports cover significant support and resistance levels and technical signals from indicators such as MACD and Parabolic SAR. The research section also includes specific trading ideas, target prices, and key price levels to watch.

OCTA’s Research

The OCTA website features a robust economic calendar, including the time, date, country, actual figure, forecast figure, previous figure, and anticipated market impact of a given economic release.

The AutoChartist plugin for MetaTrader is available to clients with $1,000 or more in their accounts. The Autochartist plugin for MetaTrader provides real-time trading signals to your terminal, shows chart patterns and trends online, and allows you to receive daily Market Reports via email.

Education

5How Did We Test the Broker's Education Offering?

How Did We Test The Broker's Education Offering?

Gaining knowledge about trading in the financial markets can make the difference between success and failure. To assess the broker's educational offerings, we personally tested and evaluated the quality of the content provided, considering its relevance for both novice and experienced traders. We explored the range of materials available, such as articles, videos, webinars, and courses. After evaluating the content's volume, update frequency, and overall quality, we compared the results with our benchmark to provide a well-rounded analysis of the broker's education offerings.

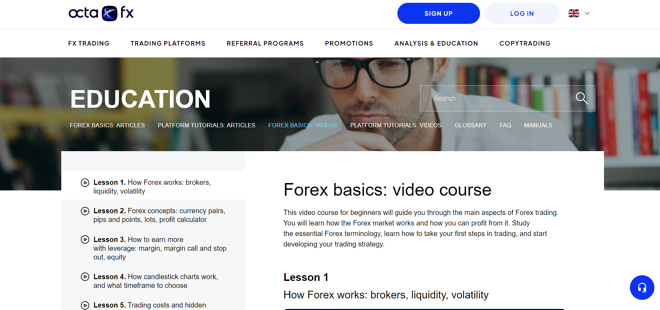

OCTA provides a solid range of educational materials, including articles, videos, webinars, and a video course. Content is updated frequently and is accessible to all levels of traders. A broad range of topics from technical analysis to trading strategies and platform tutorials are covered. With a perfect score in this category, OCTA has gone above and beyond to educate its clients.

The education section on the OCTA website is well thought out, clearly presented, and made for different levels of traders – beginners, intermediate, and experienced. Webinars play an important role and take place daily. Material includes live trading sessions, workshops, and trading strategy-themed presentations.

OCTA’s Educational Resources

In article format, OCTA provides dozens of detailed guides on subjects ranging from how to use moving averages to setting up the Autochartist Metatrader plugin. An 11-lesson course on forex basics is available in video format and makes a good primer for new traders. OCTA also provides platform tutorial videos, which cover getting started with MetaTrader, using your personal account area, and how to copy trade.